When it comes to buying a car, one of the significant concerns that buyers often face is the impact of inflation on their purchase. Inflation, the steady increase in prices over time, can erode the purchasing power of your money. So, how can you ensure that you make a smart car purchase that's not compromised by inflation? Here we will talk about actionable strategies and insights to help you protect yourself from inflation's effects when buying a car.

Understanding Inflation Dynamics

To effectively protect yourself from inflation, it's important to understand how it works. Inflation is the gradual rise in the cost of goods and services. This means that the value of money decreases over time. To counteract this, consider investing in assets that tend to appreciate with inflation, like real estate or precious metals.

Prefer Used Over New

New cars often come with a premium price. Opting for a gently used, well-maintained car can be a financially savvy move. You'll avoid the initial depreciation hit that new cars experience and potentially save thousands. To buy a used car visit Classic Elite Chevy.

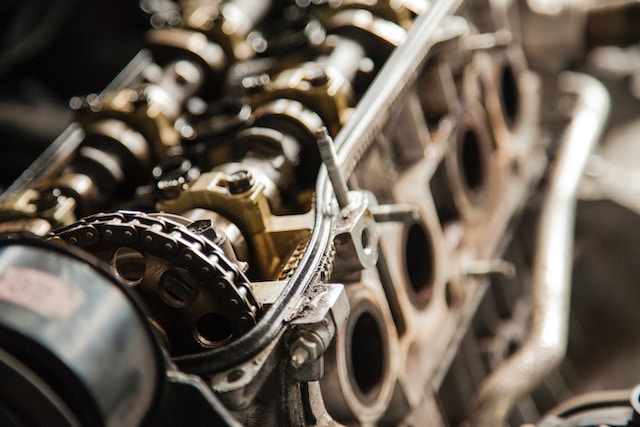

Focusing on long-term reliability can pay off. Cars that are built to last may save you from unexpected repair expenses down the road. This can be particularly beneficial during times of inflation when prices for parts and services tend to rise.

Choose the Right Financing Option

When buying a car, financing is often a necessity. Opt for fixed-rate loans rather than variable ones. Fixed-rate loans have stable monthly payments, shielding you from the potential rise in interest rates due to inflation.

Don't overlook insurance costs when calculating the overall expense of owning a car. Inflation can affect insurance premiums as well. Shop around for the best rates and consider bundling insurance policies for potential discounts.

Consider Leasing

Leasing might be an attractive option to protect against inflation. Since you're essentially paying for the car's depreciation during the lease term, you're shielded from its full market value. However, weigh the pros and cons based on your specific circumstances.

Research Resale Value

Cars with high resale value can act as a buffer against inflation. Research and choose a make and model known for retaining its value. This way, if inflation affects new car prices, your vehicle's resale value can help offset the impact.

Fuel Efficiency Matters

Fuel costs can escalate during inflationary periods. Choosing a fuel-efficient vehicle can help you save money in the long run, especially if inflation drives up gas prices.

Summary

Buying a car is a significant investment, and protecting yourself from the effects of inflation is a smart move. By understanding inflation dynamics, choosing the right financing, considering leasing, and making informed choices about the type of car you purchase, you can confidently navigate the car-buying journey even during inflationary periods. Remember to focus on long-term value, fuel efficiency, and prudent financial planning to ensure that your purchase remains a sound investment for years to come